The German federal government currently faces a crucial decision: whether to support Lilium, an innovative aerospace company, with a €50 million loan guarantee. Lilium, known for its cutting-edge work on electric vertical takeoff and landing (eVTOL) aircraft, has the potential to place Germany at the forefront of the global race in urban air mobility. However, if the government refuses to provide this financial backing, the consequences could extend far beyond a short-term financial decision—potentially costing German taxpayers far more in lost opportunities.

1. Innovation and Competitive Edge

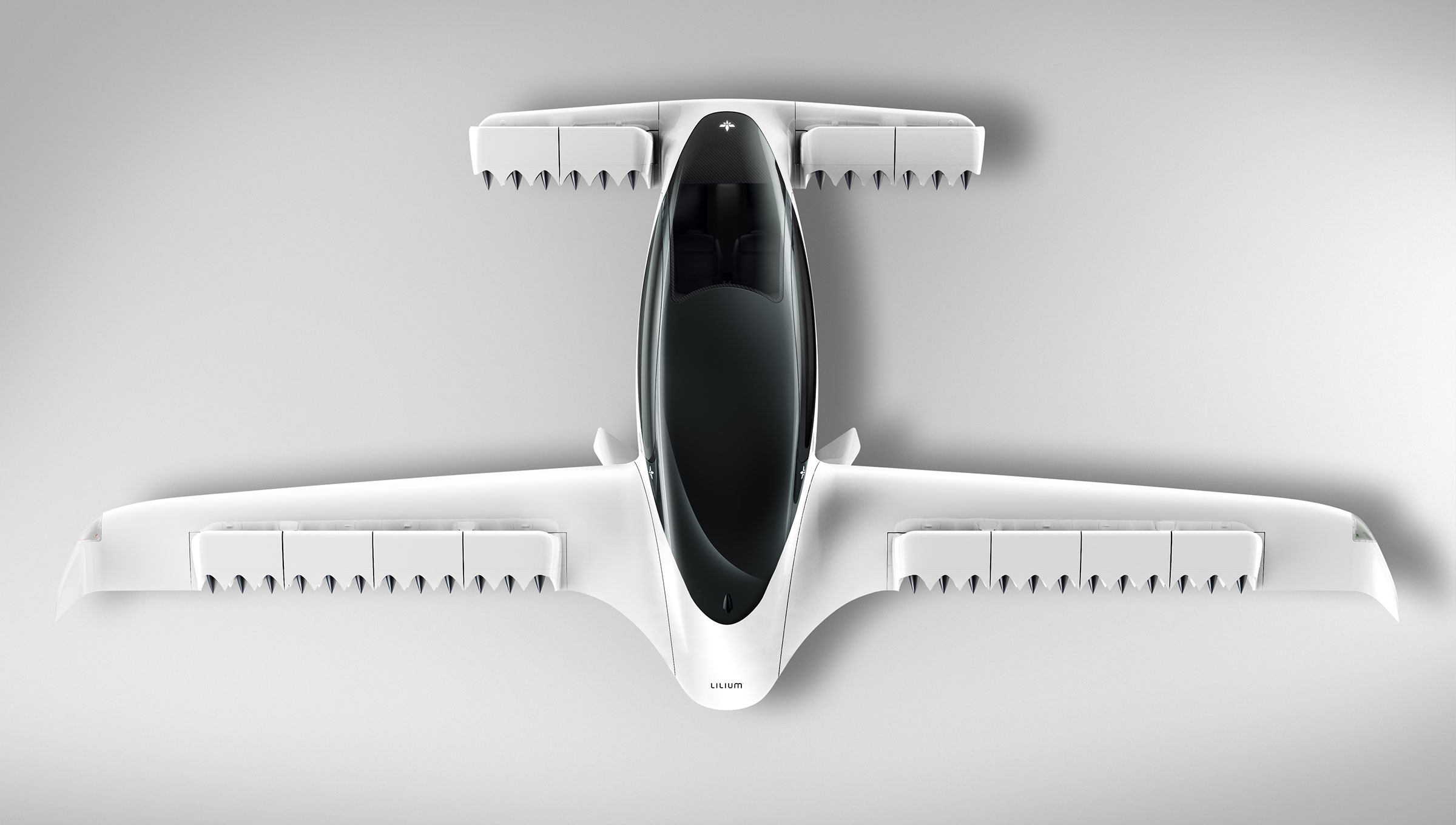

Lilium represents one of the most forward-thinking companies in the aerospace industry, developing technologies that could revolutionize transport and reduce carbon emissions. Their eVTOL aircraft promises to reduce congestion in cities, cut travel time, and provide an environmentally friendly alternative to traditional modes of transportation.

Germany has long been a leader in engineering and technology, and supporting companies like Lilium is vital to maintaining this reputation. If the government turns its back now, it risks not only losing its competitive edge to other countries, but also allowing foreign competitors to lead the way in urban air mobility. Such a missed opportunity could have lasting economic impacts, including the loss of high-tech jobs, patents, and technological leadership, all of which would have brought long-term tax revenue into Germany’s economy.

2. Job Creation and Economic Growth

Supporting Lilium isn’t just about backing a single company; it’s about fostering an entire industry. The urban air mobility market is projected to grow rapidly in the coming decades. A successful Lilium could create thousands of direct jobs in manufacturing, engineering, software development, and operations. In addition, it would stimulate secondary industries such as battery technology, advanced materials, and logistics, creating an extensive supply chain that supports the broader German economy.

If Lilium relocates or fails due to lack of financial support, these jobs will either vanish or be created in countries more willing to invest in the future of air mobility. German workers would miss out on the opportunities, and the taxes those jobs would generate for the state would instead benefit other nations.

3. Sustainability and Climate Goals

Germany is committed to achieving ambitious climate goals under the European Green Deal, and Lilium’s eVTOL technology aligns perfectly with these targets. By investing in electric aviation, the government would be accelerating the transition to cleaner forms of transport, reducing emissions, and helping to combat climate change.

Refusing to support Lilium would delay the adoption of sustainable transportation technologies and hinder progress toward these climate goals. The cost of failing to meet these targets could lead to higher penalties for the German government, increased reliance on less sustainable technologies, and higher long-term environmental cleanup costs, all of which would ultimately fall on taxpayers.

4. Innovation Spillover and Global Influence

Germany’s commitment to supporting innovative industries has a direct impact on its global influence. Lilium’s success would likely generate “spillover” effects, where innovations in one sector foster growth in others, particularly in fields like electric propulsion, AI, and autonomous flight. These technologies have broad applications beyond urban mobility, extending into sectors like defense, logistics, and energy.

By refusing to back Lilium, the government would not only hinder one company but also restrict the potential for innovation across multiple industries. This would reduce Germany’s global influence in technological advancements, allowing other nations to gain an upper hand in areas that could have benefited from German innovation.

5. Cost of Missed Tax Revenues and Social Support

Ultimately, the cost of refusing to support Lilium could also manifest in missed tax revenues. As the company scales, it would contribute significantly to public finances. Lilium’s growth would translate into corporate tax revenue, income taxes from employees, and indirect taxes from suppliers and service providers. These revenues could be used to fund public services such as education, healthcare, and infrastructure.

If the company fails to take off in Germany, taxpayers could instead face increased social support costs, such as unemployment benefits, should potential jobs not materialize. Furthermore, Germany might find itself having to import technologies from other nations that invested early in electric aviation, increasing costs for German consumers and businesses alike.

Conclusion

While the €50 million loan guarantee for Lilium might seem like a large sum, the cost of refusing this support could be far greater for German taxpayers. By investing in Lilium, the government would be taking a crucial step toward maintaining Germany’s leadership in innovation, creating high-quality jobs, advancing sustainability goals, and securing long-term economic growth. In contrast, turning away from this opportunity would leave German taxpayers to bear the brunt of lost competitive advantages, missed revenues, and increased economic and environmental costs. Investing in the future today could save Germany from far greater expenses tomorrow.

More info:

Lilium’s website click here

Bild article (in German) click here